Country and Sector Risk Barometer – October 2024 From monetary pivot to fiscal turnaround?

HONG KONG SAR - Media OutReach Newswire - 24 October 2024 - The global economic recovery presents a mixed picture. While the US economy looks set for a soft landing, the eurozone continues to face many uncertainties, particularly in the industrial sector.

China, meanwhile, is struggling to sustain its growth. Finally, our political and social risk index remains at a high level despite the fall in inflation - a sign of an increasingly complex and uncertain environment.

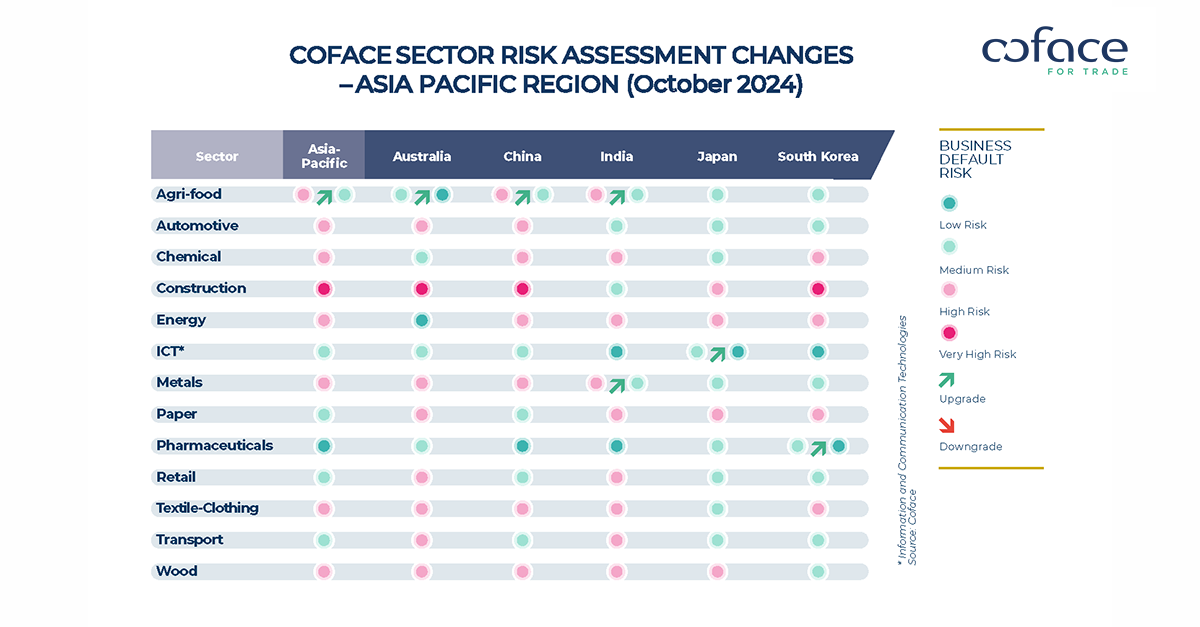

In this context, Coface has modified its ratings for 5 countries (4 reclassifications and 1 downgrade) and 17 sectors (12 reclassifications and 5 downgrades), illustrating our scenario of a stabilization of world growth in 2025, admittedly at a level below potential, but without any major upheaval.

The US economy lands, the eurozone fails to take off

After a promising start to 2024, the eurozone saw its industrial sector fall again. Its outlook is not very dynamic, as shown by the fall in the purchasing managers' confidence index. Germany, Europe's leading industrial hub, remains particularly hard hit, with manufacturing output 12% below its pre-COVID level. The services sector, which had led the recovery, is also slowing, and household consumption remains held back by persistently high savings and low levels of confidence in a context of political uncertainty.

The scenario of a soft landing seems to be confirmed in the United States. The US economy continues to show its resilience, as evidenced by the rebound seen in the second quarter (+3% annualized), with strong domestic demand, even though the labor market is gradually slowing.

Disinflation in the United States, weakening corporate sentiment in the eurozone

The third quarter of 2024 brought good news on the disinflation front, both in the United States and in Europe, again thanks to falling commodity prices - oil products in particular. However, in the eurozone, companies are still suffering from a sharp rise in unit labor costs (+4.2% year-on-year), which is squeezing their margins. After peaking in the first half of 2023 in all eurozone countries, the margin rate has fallen by almost 2 percentage points in Germany and the Netherlands, and by double that amount in Spain and Italy, leaving businesses vulnerable, as shown by the rise in insolvencies in recent months.

Time for widespread monetary easing... and austerity?

The first-rate cuts by the Fed and the ECB in 2024 mark the start of the expected monetary easing. Furthermore, while monetary policy will be more accommodative (or less restrictive) next year, more restrictive fiscal policies will have an adverse effect on growth in the vast majority of countries, particularly in the eurozone. In July 2024, the European Commission opened an excessive deficit procedure against seven countries, including France.

US elections: 2024, a decisive vote

With Kamala Harris and Donald Trump headlining the US presidential election, the choice of one program over the other will have repercussions far beyond the United States. On the domestic front, K. Harris advocates price regulation and a reduction in housing costs, while D. Trump proposes a massive tax cut and a boost to energy production (hydrocarbons). Internationally, K. Harris is seen as a guarantee of continuity in the face of a more unpredictable D. Trump. Trump, who is more unpredictable and, in some respects, more radical than during his first stint in the White House (2017-2021). Whatever the outcome, this election will have a major impact on the global economy for years to come.

China struggles to recover, while other emerging economies pick up the slack

Despite the support measures announced, the Chinese economy continues to slow, weighed down by a property market in crisis and sluggish domestic demand.

However, the emerging economies' contribution to global growth will remain unchanged in 2025, mainly thanks to the acceleration of the Gulf States and South America. This is despite the fact that we are forecasting less dynamic growth in Brazil after two years of growth of around 3%. Beyond domestic factors, many countries in the region are the big winners in the ongoing reorganization of world trade, becoming strategic relays that capture market share in Sino-American supply chains[1].

Find the full publication here

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in Trade Credit Insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk insurance, Bonding, and Information Services. Coface's experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface's insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2023, Coface employed ~4,970 people and registered a turnover of €1.87 billion.

For more information, visit coface.com.hk