Announcement of the IX Digital Asset Industry Classification System & IX Infrastructure Crypto Index

- Written by Auzzi Shopping

HONG KONG SAR - Media OutReach - 21 September 2022 - Today, IX Asia Indexes Company Limited ("IX Asia Indexes") announced the launch of the IX Digital Asset Industry Classification System ("DAICS™"), aiming to provide the professional worldwide with a transparent and standardized classification scheme to determine sector and exposure of particular digital assets.

It also serves as a tool for asset allocation and portfolio analysis for digital assets market as well as product development. DAICS™ complements IX Asia Indexes to develop their own competitive digital asset indexes and index products from a robust global standard.

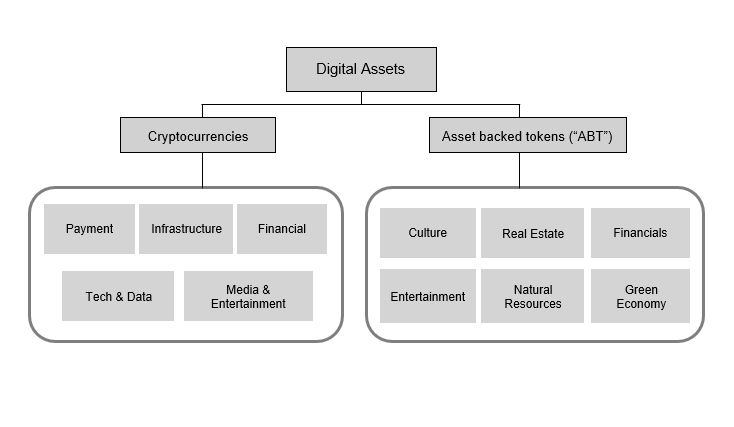

DAICS™ covers both cryptocurrencies and asset-backed tokens ("ABT"), to be reviewed semi-annually at the end of June and December. On cryptocurrencies side, it is a three-tier system that groups cryptocurrencies into 5 main industries: 1) Payment, 2) Infrastructure, 3) Financial services, 4) Technology & Data and 5) Media & Entertainment. These industries are further divided into 13 industry sectors and sub-sectors to be introduced in the future. Under asset-backed tokens, there are 6 asset types and 30 branches. They are: 1) Culture, 2) Real Estate, 3) Financials, 4) Entertainment, 5) Natural Resources and 6) Green Economy. (For DAICS™ please see Appendix 1 and 2)

Initially IX Asia Indexes will only classify the top 50 cryptocurrencies in terms of market capitalization which already represent over 80% of the market share in terns of market size and volume. ABT classification work will be added in next stage when a fair population of popular asset-backed tokens are available in the market. The current asset types and branches of the ABT category is to provide a first stage according to more foreseeable industry demand. As the market further matures with more cryptocurrencies with strong use cases emerge, the Classification System may expand to include more cryptocurrencies, ABT, industries, sectors and subsectors. (For more details on the grouping of cryptocurrencies under DAICS™, please refer to Appendix 3)

In response to the common global effort to achieve net zero emission by 2030 and 2050 agenda for the 17 sustainable development goals (SDGs) by United Nations, IX Asia Indexes anticipates that more tokenisation will adopt the SDGs. Our vision is that ESG and sustainability is more than environmental impact, which also includes sustainable growth and development, good governance, better social impact and community engagement. To promote this, the DAICS™ introduces "green" labelling for cryptocurrencies that adhere to the principle of sustainability by employing energy efficient protocol or making an active effort in minimising environmental damages. Under the ABT cataegory, a "Green Economy" asset type is introduced for token that represent ownership of the projects that ahere to the United Nations 17 sustanable development goals. An index which can represent the Asia Pacific Green Economy is also under study.

To complement with the DAICS™" launch, a IX Infrastructure Crypto Index will be launched and available hourly 7x24 on the official website https://ix-index.com/ after the third quarter end index review. A reference on the weightings among the different crypto industry sectors are shown in Appendix 4.

For further information regarding the methodology of the DAICS™, please refer the "IX Digital Asset Industry Classification System- principle and guilding methodology" available on the company website.

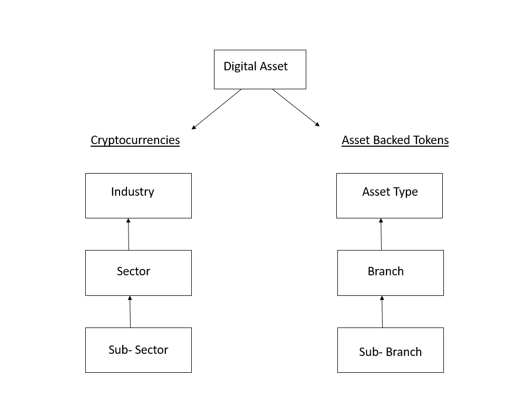

Appendix 1

The structure of DAICS™

Appendix 2

IX Digital Asset Industry Classification System ("DAICS™")

Appendix 3

Classification of top 50 coins by Market Capitalisation *

| Catagory | Industry | Sector | Cryptocurrencies | |

| Cryptocurrencies | Payment: Blockchain based money, designed for transactional purposes. This includes daily transactions usage and stablecoins. | Transaction & Payment | BTC XRP ADAG LTC CRO | XLM XMR BCH BSV ZEC |

| Stablecoin | USDT USDC BUSD | DAI TUSD | ||

| Infrastructure: Bedrock blockchain that facilitates the operation of other decentralised applications. This includes the creation and running of dedicated blockchain platforms, achieving interoperability between networks, increasing the amount or speed of transactions etc. | Application Development Protocol and Smart Contract | ETHG SOL AVAX TRX ETC NEAR | FLOW ALGOG ICP XTZG HBARG EOS | |

| Interoperability | DOT LINK | ATOM QNT | ||

| Scaling | MATIC | EGLD | ||

| Supporting System | HNT | | ||

| Financial services: Tokens that provide on-chain asset management services, crypto-exchange services, funding, lending and other capital markets related services | Exchange Tokens | BNB UNI LEO | FTT OKB | |

| Lending and Borrowing | AAVE | MKR | ||

| Tech & Data: Provision of data management and storage, and development of innovative crypto technology | File storage & Sharing | VET | FIL | |

| Media & Entertainment: Recreational and media services. Including content creation and distribution, advertising through crypto-asset incentive mechanisms, gaming and collectibles | Social Media | DOGE | SHIB | |

| Streaming | THETA | | ||

| Gaming | APE | AXS | ||

| Metaverse | MANA | SAND | ||

Appendix 3

| Catagory | Asset Type | Branch |

| Asset-Backed Tokens | Culture: Real asset relating to sports, art, cultural drama, festive collectibles and design IPs etc. | Art |

| Sports | ||

| Festive Collectibles | ||

| Design IPs | ||

| Drama and Play IPs | ||

| Real Estate: Assets that mainly derived its valuation from property, real estate, and land | Commercial Property | |

| Residential Property | ||

| Governmental Property | ||

| Residential and Commercial Land | ||

| Financials: Real financial asset including listed company shareholdings on regulated centralised exchanges and private company shareholdings; debt instruments; property trusts and derivatives that settled on regulated exchange (CeFi and DeFi). | Tokenised Securities (Company Securities, ETF) | |

| Tokenised Debts | ||

| Tokenised REITs | ||

| Entertainment: Ownership of the IPs assets in the area of entertainment in real world such as concert, play, shows, circus, musicals, songs, movies, events and programs, and souvenir collectibles that is derived from the above areas | Movies | |

| Songs | ||

| Concerts | ||

| All Other Entertainment Events and Collectibles | ||

| Natural Resources: Natural resources asset that derived directly from sea, sky, atmosphere and underground and can be classified as a commodity with standardisation such as precious metals, agricultural, energy and metals. | Precious Metals | |

| Agricultural | ||

| Energy | ||

| Metals | ||

| Green Economy: Ownership of Projects Asset that falls under the definition of the UN 17SDG²s, with over 80% of the income or jobs provided on these 17 initiatives. | No Poverty & Zero Hunger | |

| Good Health and Well-Being | ||

| Quality Education | ||

| Gender Equality | ||

| Clean Water and Sanitation/Affordable And Clean Energy | ||

| Decent Work and Economic Growth/ Industry, Innovation, and Infrastructure/ Partnerships for the Goals | ||

| Reduced inequalities/ Peace, Justice and Strong Institutions | ||

| Sustainable Cities and Communities/Responsible Consumption and Production | ||

| Climate Action | ||

| Life Below Water & Life on Land |

² United Nations 17 sustainable development goals covering 1) No Poverty 2) Zero Hunger 3) Good Health and Well-Being 4) Quality Education 5) Gender Equality 6) Clean Water and Sanitation 7) Affordable And Clean Energy 8) Decent Work and Economic Growth 9) Industry, Innovation and Infrastructure 10) Reduced inequalities 11) Sustainable Cities and Communities 12) Responsible Consumption and Production 13) Climate Action 14) Life Below Water 15) Life on Land 16) Peace, Justice and Strong Institutions and 17) Partnerships for the Goals https://sdgs.un.org/goals

Appendix 4

Sector Weighting of the Classification System*

| Industry | Weighting (%) |

| Payment | 61.50 |

| Infrastructure | 28.45 |

| Financial Services | 7.16 |

| Tech & Data | 0.43 |

| Media & Entertainment | 2.46 |

Hashtag: #IXAsiaIndexes

The issuer is solely responsible for the content of this announcement.

About IX Asia Indexes

IX Asia Indexes Company Limited ("IX Asia Indexes") is the leading alternative asset index compilers in Asia. Its services in the areas of both real and digital assets cover index consultancy, index design, index calculation and dissemination, and index education. It is missioned to bring transparency and standardization to the digital asset and tokenisation world through building an investment-grade and rules-based benchmarks.

IX Asia Indexes launched the award winning ixCrypto Index (IXCI) in 2018, followed by two new Indexes ixBitcoin (IXBI) and ixEthereum (IXEI) Index under the ixCrypto Index Series in early 2021. The company won 2019 and 2021 ETNET Fintech Award under Wealth Investment and Management catagory. IX Asia Indexes also won two awards of "Startup of the Year" and Big Data from Hong Kong Fintech Development Awards 2022 hosted by Metro Finance and co-organized by KPMG. ixCrypto Index Series is currently available in 85 countries via Nasdaq and IX Asia Indexes Company data feed to Bloomberg, Reuters, banks institutions and information vendors. 14 real time indexes are disseminated every 5-second for 7x24 since 23 June 2022. In response to growing investors demand for exposure to boarder crypto market and diverisification, IX Asia indexes launched 6 new IX Crypto Portfolio Indexes in August 2022.

For more information, please visit https://ix-index.com/

About IX Asia Tokenization Advisory Committee and Working Group

The establishment of the IX Asia Tokenisation Advisory Committee ("Advisory Committee") is to pursue the goal and vision to formulate a standard for global tokenization framework in a compliant and transparent way. The key role of the Advisory Committee is to formulate the guideline and reference for tokenization in terms of infrastructure, business financial stability, sustainability, internal control and classification. The Advisory Committee is comprised of industry recognised leaders from blockchain consultancy, sustainable projects and field in Art industry.

The establishment of the Working Group is to identify, evaluate and recommend key directions and founding principles according to their specific industry knowledge and expertise in relating to the creation of the specified token. It will examine and propose improvements to the guidelines and

references for tokenization. The working group is formed of a diverse group of market experts representing relevant sectors and markets, to provide input and discuss case studies for creation of tokenization framework, best practices and development of real-world projects.

For more information about IX Asia Tokenization Advisory Committee & Working Group, please visit https://ix-index.com/tokenization-committee.html