July 2019 Bitcoin Market Update and Outlook

Bitcoin continues to be on high heels in 2019, as the price managed to recover from a bear market that brought to its knees the cryptocurrency market. From the January 1st opening price towards the June high, Bitcoin managed to bank an impressive 376.8% return, above anyone’s expectations, but lately, the price action had become volatile.

Many of the analysts put the Bitcoin revival on the back of stronger institutional investments. People are now able to trade futures contracts or trade Bitcoin with brokers like easymarkets.com and do not need to rely on the traditional exchange platforms that proved to have security issues and lack of regulatory oversight.

Bitcoin technical analysis

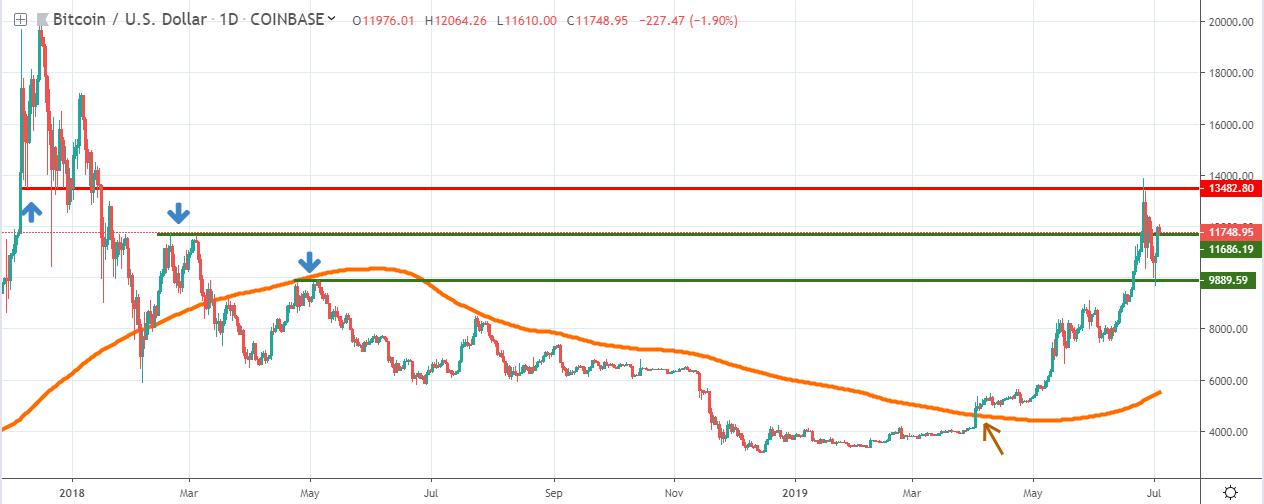

Between January and April, Bitcoin volatility had been very low, similar to the September-November 2018 period, but everything changed on April 1st when the price of Bitcoin broke impulsively above the 200 daily simple moving average, a key indicator treated as a dividing line between bearish and bullish territory.

Since then, Bitcoin continued to surge towards a high of $13,864 on the Coinbase exchange, clearing several important key resistance areas. Interestingly, though, the rally ended around the previous December 2017 floor and the past week saw Bitcoin posting the most impulsive retracement in 2019.

So far, support had emerged around the $10,000 area, which coincides with a swing-high made back in May 2018. Even though buyers treated the area as support, if we look at the bigger picture we see the trend had become highly unstable due to the latest drop and any trader’s view on Bitcoin should be neutral right now, until any new major developments will occur.

From a market sentiment point of view, we’ve reached the extreme confidence zone and what’s even more interesting to note is that futures traders on the CME are already expecting Bitcoin to post a much deeper retracement lower.

The optimism had been fueled by the announcements of new Bitcoin futures, besides the ones currently trading on the CME. Futures contracts based on Bitcoin posted several new record volumes as the price continued to surge, but we suspect we’ve entered a wait-and-see period for the largest cryptocurrency.

Until any significant breakout will take place, we expect Bitcoin to trade in a range between $10,000 and $13,500. The direction of the range breakout will determine the next significant move and judging by the latest developments we suspect there’s a 60% probability Bitcoin will break on the downside in the following weeks or months.

Source: tradingiview.com