2023 Coface China Corporate Payment Survey : Companies Report Shorter Payment Delays In 2022 And Expect Higher Economic Growth In 2023

- Written by Auzzi Shopping

Hong Kong SAR – Media OutReach - 23 May 2023 -

- Coface' surveyshows that fewer firms encountered payment delays in 2022. 40% of respondents reported overdue, down from 53% in 2021.

Bernard Aw, Chief Economist for Asia Pacific at Coface, said: "Despite businesses facing an economic slowdown in 2022 due to the Omicron wave and the subsequent strict lockdown response, credit terms lengthened during the year. Chinese businesses had to be more flexible as their customers needed more time to make payments amid tight liquidity and mobility restrictions that disrupted payment processes. The average payment terms increased from 77 days in 2021 to 81 days in 2022.

With companies offering longer payment terms, fewer reported payment delays in 2022: the share of respondents reporting overdue fell from 53% in 2021 to 40%, the smallest share in the past five years.

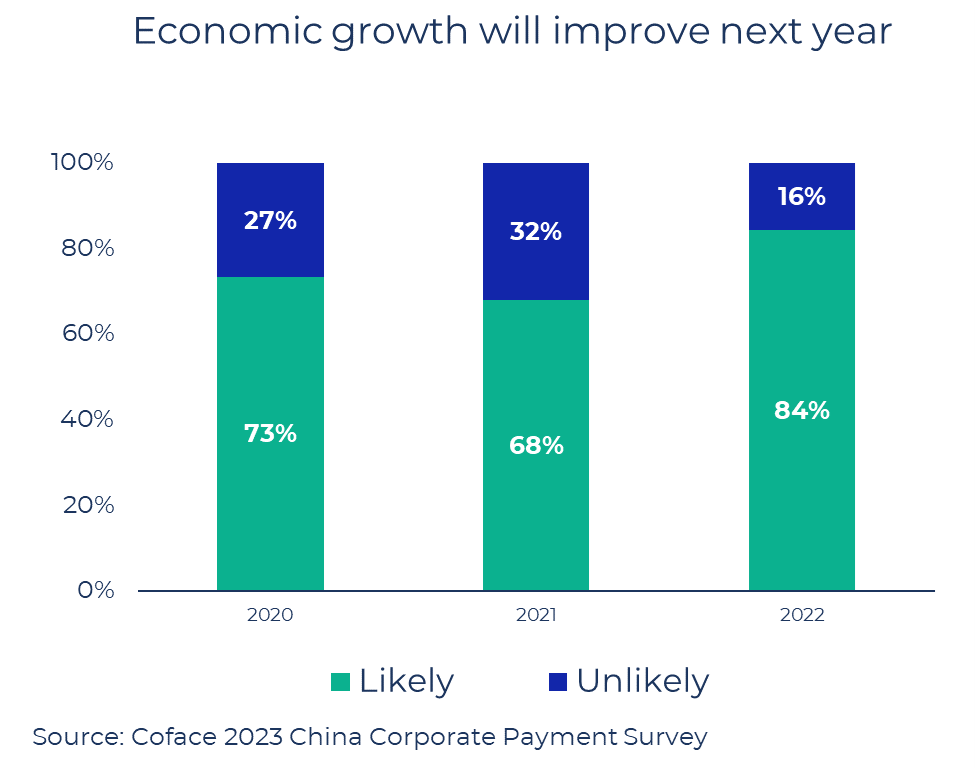

Looking ahead, respondents were increasingly optimistic about economic prospects in the next 12 months as the Chinese government transited away from its zero-Covid policy at the end of 2022. The share of respondents expecting higher economic growth rose from 68% in 2021 to 84%.'

Payment delays[1] : Increased funding risk for chemicals and wood ; Construction under pressure

The survey also showed that fewer companies experienced ultra-long payment delays (ULPDs) exceeding 2% of annual turnover. After a significant rise in 2021 with 64% of respondents reporting such delays, the proportion fell to 36% - the lowest since 2016. As 80% of ULPDs are never paid according to Coface's experience, a company's cash flow could be at risk when they constitute a share of annual turnover above 2%.

In 2022, 34% of respondents from the chemical sector reported their ULPDs more than 10% of turnover, up by 8 percentage points from 2021. This is the highest among all 13 sectors. The financial health of the wood sector also deteriorated. More respondents of the sector reported an increase in the value of overdue (40% from 33% in 2021).

After a restrictive policy with stricter financing rules for real estate developers, the Chinese government has eased its tough stance towards the developers, especially towards the end of 2022 with a significant 16-point policy package in November. However, construction remains the sector with the longest payment delays of 96 days amid the housing market correction.

30% of respondents across sectors reported rising raw materials prices as the main reason for payment delay, up from 23% in 2021. The surge in commodity prices following the war in Ukraine and the remaining pressure on the supply chain led prices for inputs to increase sharply in 2022, putting greater pressure on companies' finances.

Economic Expectations: Greater optimism after the end of zero-Covid

The strict Covid policy in China greatly hit businesses in 2022. While rising raw material prices and a decline in demand were major factors affecting cash flow and sales, highlighted by 24% and 23% of respondents respectively, 61% of respondents indicated that the impact of an insufficient workforce due to lockdown measures was the top factor affecting cash flow and sales.

Expectations of sales and cash flows in the next 12 months showed greater optimism, albeit more modest. Those anticipating improved sales performance in the coming year rose from 44% in 2021 to 50% in 2022. The rise in those projecting improved cash flow was larger, from 27% in 2021 to 49% in 2022.

Looking ahead, respondents were increasingly optimistic about economic prospects in the next 12 months as the Chinese government transited away from its zero-Covid policy at the end of 2022. The share of respondents expecting higher economic growth rose from 68% in 2021 to 84%. Coface expects China's GDP growth to accelerate to between 4% and 5% in 2023.

https://www.coface.com/News-Publications/Publications/China-Payment-Survey-2023-Shorter-payment-delays-but-worsening-credit-conditions-in-chemicals-and-wood

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in trade credit insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk Insurance, Bonding, and Information Services. Coface’s experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface’s insight and advice, these companies can make informed decisions. The Group's solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2022, Coface employed ~4,720 people and registered a turnover of €1.81 billion.